Go Back

AfriOne

Role: Product Design, UI Design , Prototyping

Industry: Finance, Blockchain

Overview

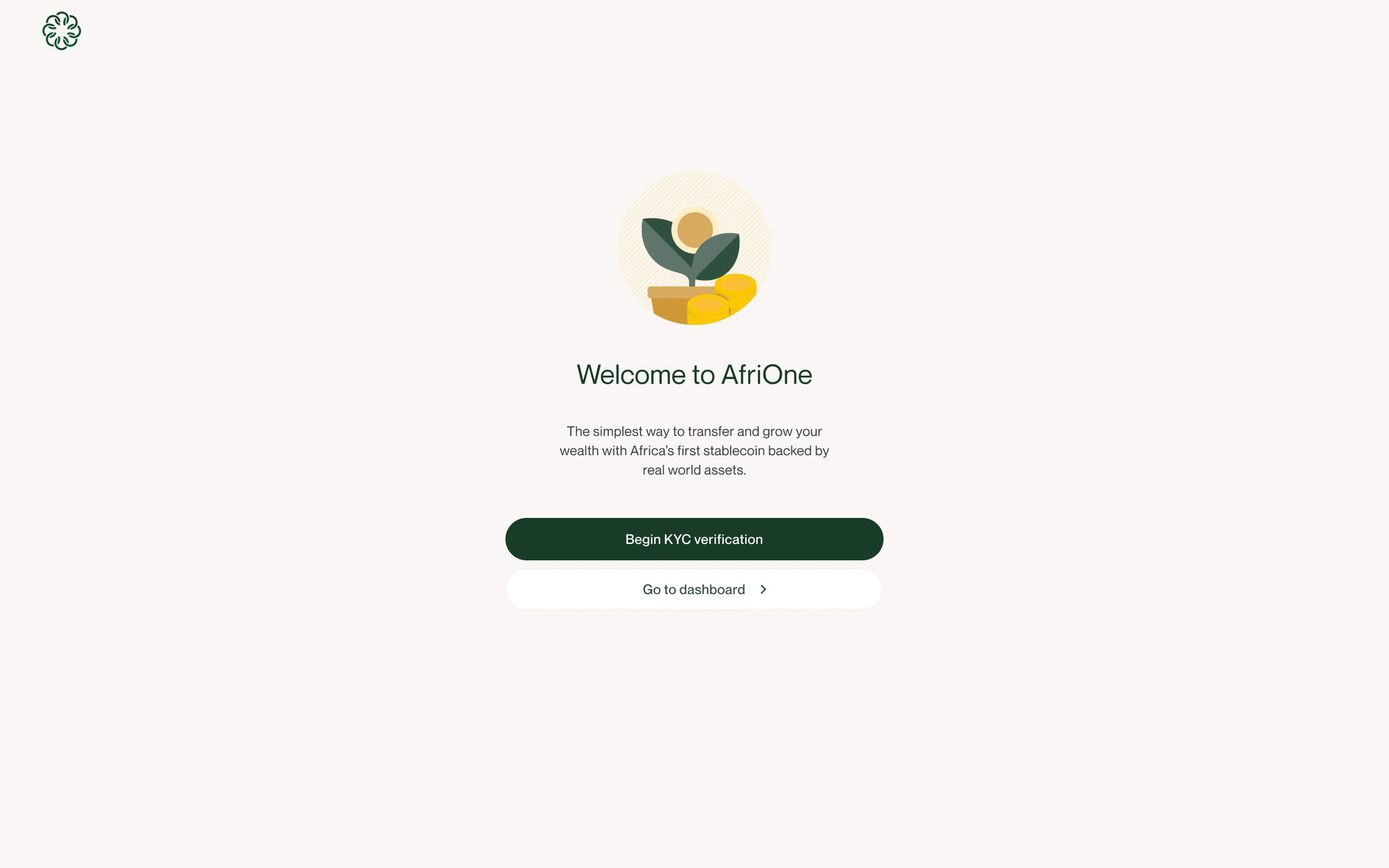

Product: AFRI B2B Token Platform: Web Application Core Technology: Ethereum & Tron Blockchains Focus Markets: Nigeria & Ghana

AFRi is a B2B crypto-payment solution designed to bypass the friction of traditional international payment rails (SWIFT, etc.). By using a proprietary token as a bridge asset, AFRI enables businesses in Nigeria and Ghana to settle cross-border transactions instantly, cheaper, and with greater transparency.

Challenge

Businesses operating between West African nations face significant hurdles:

High Latency: Traditional bank transfers (SWIFT) can take 3-5 business days to settle.

Currency Volatility: Fluctuating exchange rates during long settlement windows create financial risk.

Regulatory Friction: High barriers to entry for opening foreign currency domiciliary accounts.

The Goal: Design an MVP (Minimum Viable Product) that prioritizes core payment functionality, settlement efficiency, and strict adherence to KYC/Compliance protocols for businesses.

The Solution: "Mint & Burn" Architecture

The product moves away from complex crypto-trading interfaces, focusing instead on a "Mint & Burn" utility model hidden behind a familiar fintech UI.

Minting (On-Ramp): Businesses pay local fiat (Naira/Cedi) to receive AFRI tokens.

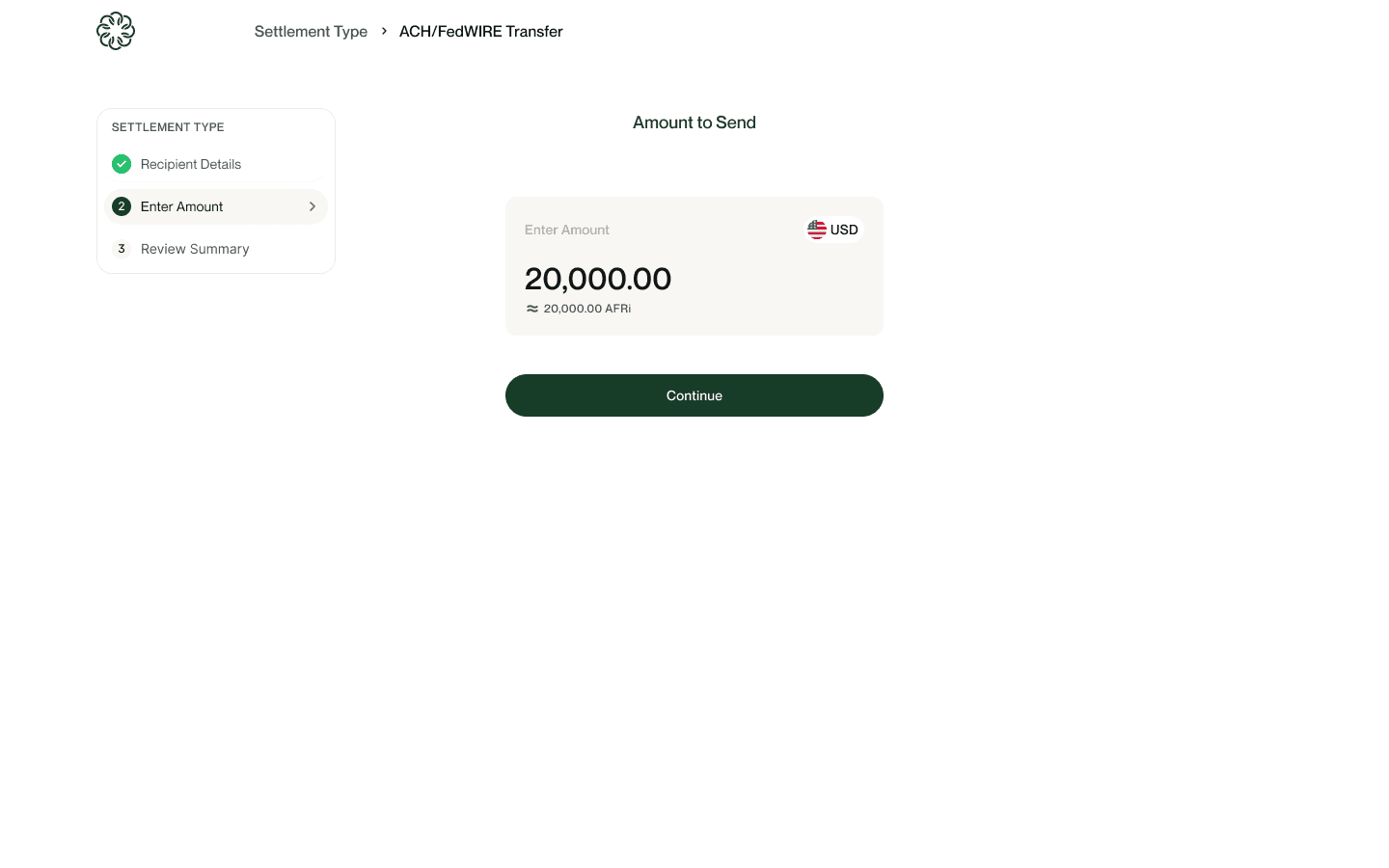

Sending/Burning (Off-Ramp): Businesses send AFRI tokens, which are "burned" at the destination to release fiat (USD, GBP, EUR) to the recipient via local rails (ACH, SEPA, FPS).

Key Design Modules & User Flows

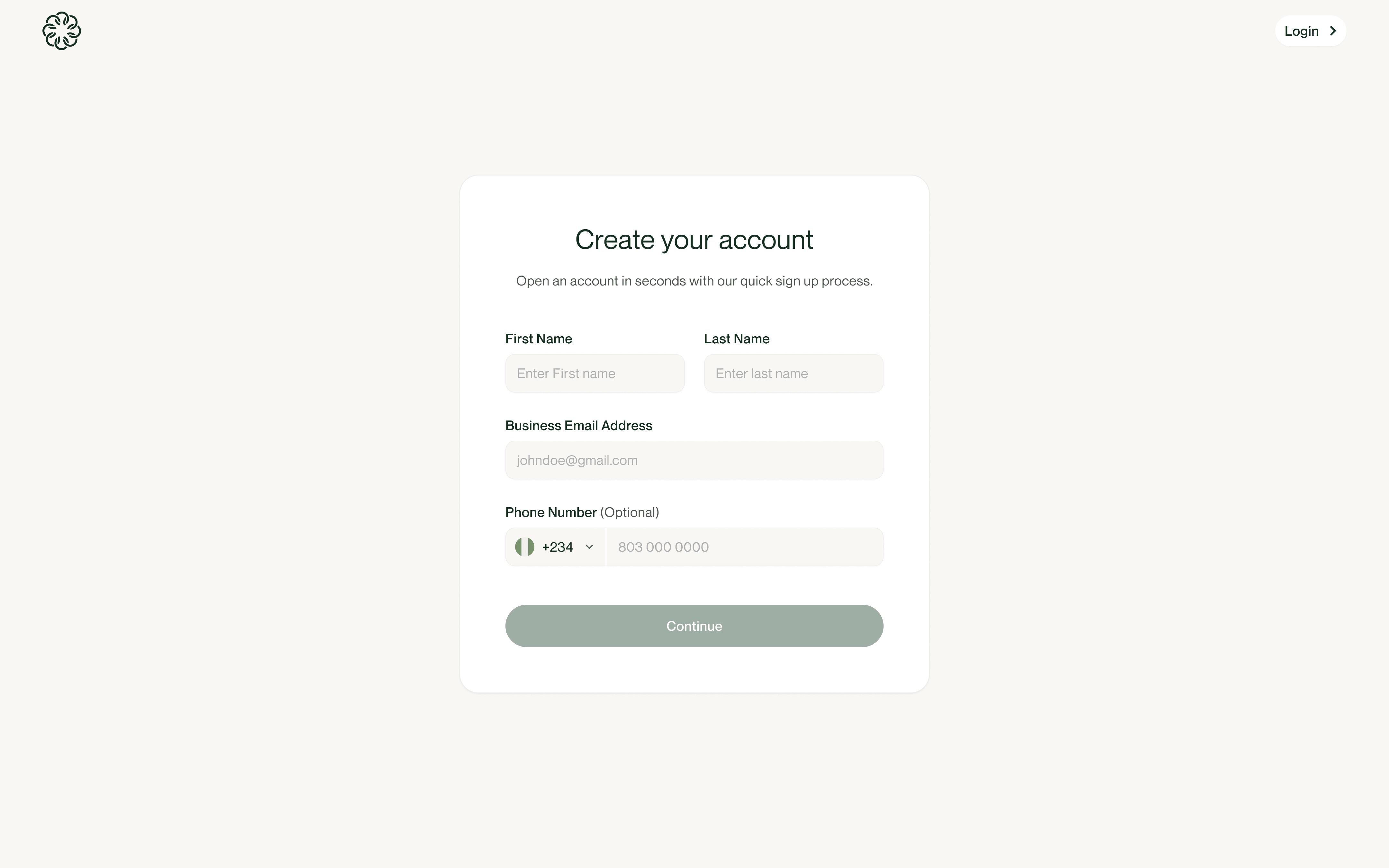

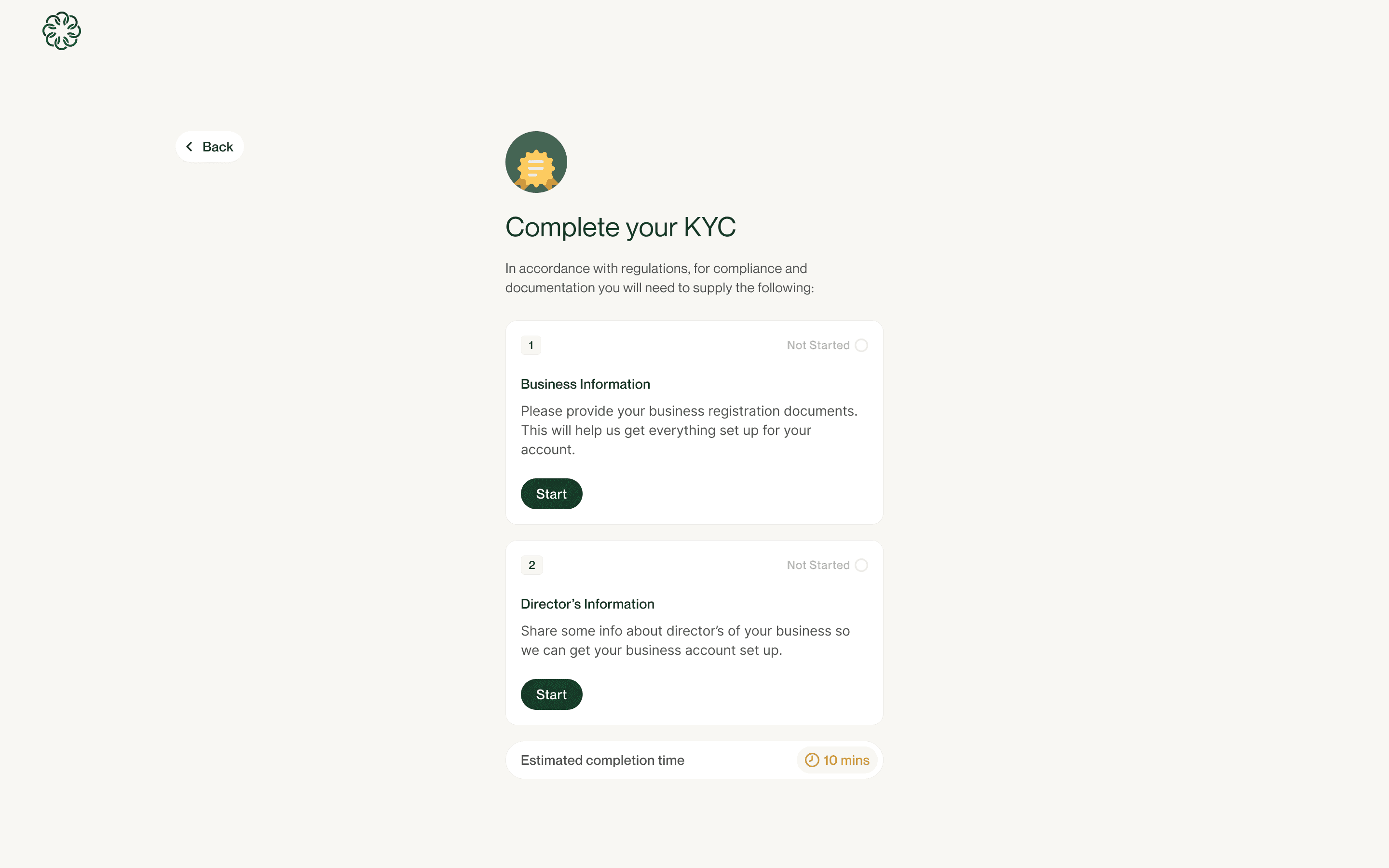

A. Corporate Onboarding & KYC (Compliance First)

Context: Unlike B2C apps, B2B requires rigorous verification. The design challenge was to make a document-heavy process feel linear and manageable.

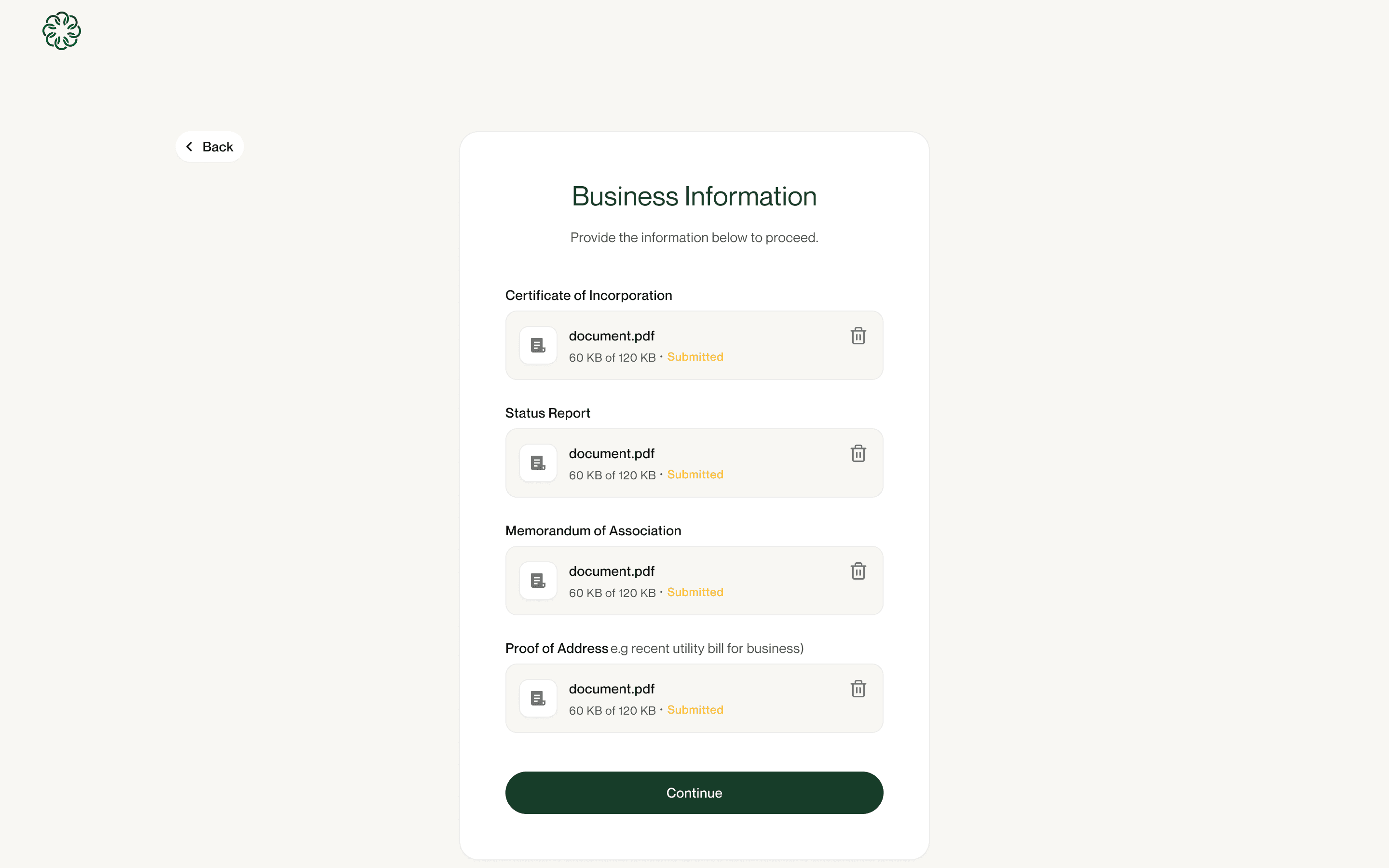

Requirements Translated to Design:

Nigeria Flow: Integration of Director details (>15% shares), PEP (Politically Exposed Person) checks, and BVN/NIN verification.

Ghana Flow: Integration of Ghana Card and Utility Bill verification.

UI Solution: A progressive stepper UI was utilized to break KYC into 2 major steps: Business Information -> Director's Information

B. The "Minting" Experience (Buying AFRI)

User Story: "As a business user, I want to fund my account to buy AFRI."

Design Decision: We avoided crypto jargon like "Swap" or "Exchange." instead using "Fund Account".

The Flow:

User selects token type to fund

User enters amount in Fiat (e.g., NGN 5,000,000).

System auto-calculates the AFRI token equivalent based on live rates.

Dynamic Virtual Account: Upon confirmation, the system generates a one-time bank account number for the user to transfer funds to (simulating a standard bank transfer).

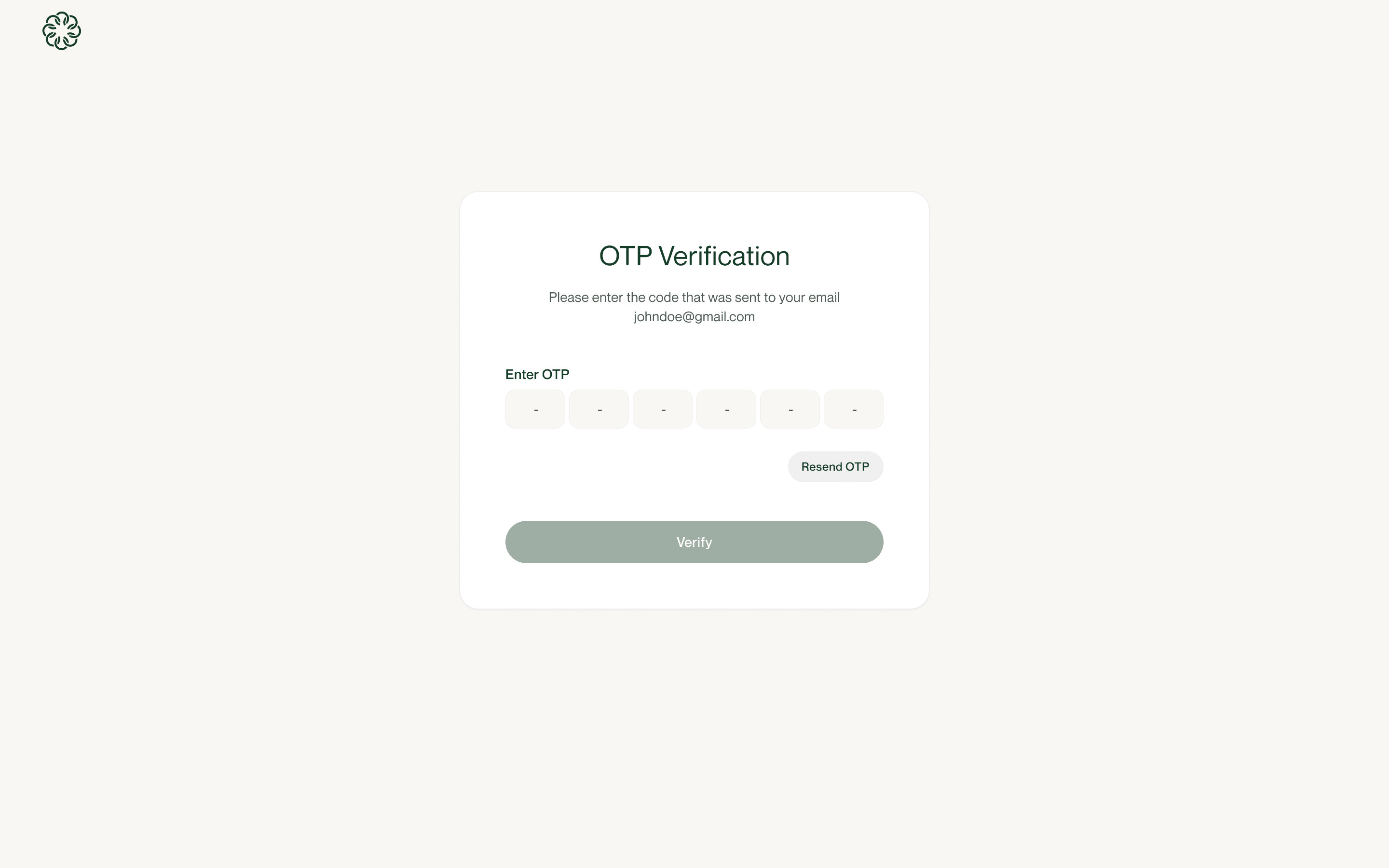

Security Features

To build trust with enterprise clients, security features were brought to the forefront of the UI:

Mandatory 2FA: Required for login is a 6 digit verification code.

Transaction PIN: A distinct 4 digit code required specifically to authorize the final outflow of funds, separate from the login password.

Future Roadmap (Post-MVP)

The initial design lays the groundwork for upcoming features:

Multi-User Management: Admin vs. Viewer roles.

Limit Management: Custom transaction limits for different staff members.

Reward System: Incentivizing high-volume settlements.

Reflection

Designing AFRI required balancing the technical complexity of blockchain (Ethereum/Tron minting) with the simplicity expected by traditional business owners. The result is a hybrid interface that feels like a bank but moves with the speed of crypto.